OVERVIEW:

In order to run a financially successful business, you will need to learn how to track your earnings and spending and how to make sure you always have enough cash in your bank account to meet your obligations. This session provides a guide for good financial organization, explains both accounting and cash flow in simple terms, discusses potential tax liability issues, and introduces different financial experts who can provide assistance before you start.

By the end of this lesson you should be able to:

- Organize yourself and your business to keep good financial records.

- Understand the basic financial reports used to monitor the health of your business.

- Evaluate your business’s financial reports for signs of trouble.

- Know the different kinds of accounting professionals.

- Identify the importance of having a team of financial experts to help you.

- Step One: Build Your Knowledge

- Why is Financial Information Important to Your Business?

- What is the Difference Between bookkeeping and Accounting

- What are Financial Statements and Why do You Need Them?

- How do I Keep Track of all the Financial Information I Need?

- The Chart of Accounts

- How to Track What is Important

- Methods of Accounting

- Keeping Business and Personal Money Separate

- Step Two: Gather Your Accounting Team

- Select Your Tax Accountant

- Select a Payroll Provider

- Start a Banking Relationship

- Financial and Technical Assistance

- Step Three: Getting Started

- Internal Controls

- Working With a Hired Bookkeeper

- Bank Account Reconciliation

- Tax Liability Issues

- Summary

- Accounting and Cash Flow Action List

- Top 10 Do's and Don'ts

- Business Resources

Watch this session in video format (45:00)

Why is Financial Information Important to Your Business?

If you're going to be in business, you must know how to keep track of what you earn and what you spend. Bookkeeping software has made tracking your financial activities easier than ever. With some basic knowledge and support from a professional tax accountant, you can take care of most of the day-to-day bookkeeping yourself. Once you understand basic accounting, it also makes it easier to work with a professional bookkeeper if you decide to hire one.

You may have heard the statistic that, according to the Small Business Administration (SBA), roughly one in five businesses will fail in their first year. Only about half of all new businesses will make it to five years, and only 30% of businesses will make it to year 10. The two biggest reasons for business failure are lack of sales (the market doesn’t know about or doesn’t want the products or services offered) and cash flow—not having the cash needed to meet financial obligations when it is needed. Fortunately, both those problems have simple solutions. And, it is absolutely worth the effort to solve those challenges because the SBA also tells us that on average, self-employed people are generally significantly wealthier than regular employee workers.

So, how do you keep yourself from becoming a statistic? Easy. Know your numbers and have a cash management plan.

Small business financial needs are very different from those of large corporations, but the terminology is all the same, so let’s start with some definitions.

What is the Difference Between Bookkeeping and Accounting?

Accounting refers to the bigger picture, where your financial transactions and financial information are combined in standard reports, or financial statements. These standard reports help you (as well as partners, lenders, advisors, and other stakeholders) understand the financial health of your business so you can make wise financial decisions. Bookkeeping is the basis of accounting. A professional accountant, also referred to in this session as a tax accountant, will gather the information from the bookkeeper (either the hired bookkeeper or the business owner) to create financial statements, prepare tax reports, and file taxes on behalf of the business.

What are Financial Statements and Why do you Need Them?

Financial statements are the standard reports every business prepares to summarize financial information to give a complete picture of the business.

The three most important financial statements are the Balance Sheet, the Profit and Loss Statement, and the Statement of Cash Flow.

The Profit and Loss Statement, also called the Income Statement, shows how your business earned and spent money, and if the business is profitable or not.

The Balance Sheet shows how much the business is worth, including everything others owe to the business (assets), everything the business owes to others (liabilities), and everything the business owns (equity).

The Cash Flow Statement summarizes the movement of cash and cash equivalents (like credit card and loan payments) that come in and go out of the company. The Cash Flow Statement measures how well a company manages its cash (money) and if the company generates enough cash (money) to pay its operating expenses and debts.

As a business owner, you need to feel comfortable understanding what each of these reports is telling you about your business. These reports will help you make better financial decisions and keep you from getting into a difficult financial situation.

EXAMPLE: Landscape Services LLC

Landscape Services LLC is a company that provides landscaping design and construction to homeowners. It is a small company with one owner and two employees and annual revenues of about $190,000. The Profit and Loss Statement for Landscape Services LLC (PDF) shows revenue from design services, landscaping services, and the sale of materials and plants to customers. Expenses include the cost of materials and plants, salaries and wages, and other operating expenses like utilities and fuel. Income before taxes and interest was $13,349 and after taxes and interest was $10,754.

The Balance Sheet for Landscape Services LLC (PDF) shows the assets and liabilities of the company on a specific date, June 30, 2025. The main assets are cash in the checking and savings accounts, accounts receivable (money owed to the company), inventory of materials and plants that have not been used yet, a truck, and equipment. The company’s liabilities are accounts payable (money owed by the company to suppliers – probably unpaid invoices), a credit card balance (money owed to the credit card company), and a long-term loan (perhaps for the truck).

The difference between the assets and the liabilities is the equity in the company - basically how much the company is worth, on this day, based on this short list of assets.

The Cash Flow Statement for Landscape Services LLC (PDF) shows how cash was collected and spent over the course of the year. It starts with the cash on hand (in the checking and savings account) at the beginning of the year, July 1, 1024. Cash coming in and going out for operations, investments, and financing are added or subtracted from the starting cash to calculate the ending cash balance, on June 30, 2025.

Cash flow from operating activities is cash going in and out for operations – all the activities associated with providing goods and services to the company’s customers during the year. Cash receipts for the year were $187,976. To generate these sales, the company incurred expenses for materials and plants, wages and salaries, other operating expenses, interest, and taxes. All are shown on the cash flow statement.

In addition to the cash used for operating activities, cash was used for investing (purchasing equipment) and for financing (payments on the outstanding bank loan). The cash flow statement shows that there was $12,747 at the end of the year after adding and subtracting the movement of cash in and out of the company.

While this cash flow statement covers an entire year, it is common for small businesses to create monthly cash flow statements to monitor the flow of cash in and out of the company more frequently.

How do I Keep Track of all the Financial Information I Need?

The best way to keep track of what you earn, what you spend, what you owe, and what you own, is to set up a bookkeeping system to organize your receipts and transactions. As a general rule, it’s a good idea to keep all receipts and bank statements for three years.

If you are a solopreneur or a sole proprietor, operating your business on your own, you may choose to create a process where you place every receipt or bill in a designated spot in your home or working space, and once a week you enter the expenses and payments on a piece of paper or spreadsheet. It is important to keep careful track of all the dates, amounts, reasons for the expenses, and to save all your receipts. It can be helpful to make notes directly on receipts or invoices as you get them to keep track of the business purpose of the expense or payment .

You may also decide that it’s helpful to bring your bookkeeping online with some bookkeeping software like Quickbooks, Xero, Wave, or others. An advantage of bookkeeping software is that it can track everything in one place by connecting your transactions with your business bank account. Most software even allows you to upload photos (taken with your smartphone) or files (PDFs) of your receipts, so you don’t have to keep track of the paper receipts any more.

No matter what system you use, you will need to start with a customized Chart of Accounts to define the accounting categories you will use when entering your transactions.

The Chart of Accounts

The Chart of Accounts is a list of all of the accounting categories you will use to record how you earned, spent, moved, and kept your money. Usually your chart of accounts will have an account for every line on your balance sheet and every line on your profit and loss statement. Most bookkeeping software comes with a default Chart of Accounts that suggests the different types of accounts you will need.

Not every business has every type of account. The best way to start a chart of accounts is to think of where you earn money, how you spend money, and where you keep your money and then make sure you have accounts to match. For example, if you send invoices to customers, then you need an account for Accounts Receivable. If you borrowed money for your business, then you need an account for long term liabilities. It is a great idea to get a professional bookkeeper to review your Chart of Accounts with you!

Let’s start by defining accounts from the profit and loss statement. Then we will take a look and define some accounts that are appropriate for more complex businesses.

Profit and Loss Statement Accounts

Every business has sales and expenses, so every business must have accounts to keep track of sales revenue (or income) and other accounts to keep track of business expenses.

- Revenue and income accounts

- Service Revenue or Income accounts: In service revenue or income accounts you keep track of money earned by the business through sales of services. While you only need one income category to track your sales, it can be helpful to specify your different revenue streams so you can see how your different activities bring in money. For instance, if you are a musician, you may wish to track your revenue from teaching music separately from your revenue from playing music. If so, you would want two different service revenue accounts.

- Product sales revenue or income: In product sales revenue or income accounts you keep track of money earned by your business from selling goods or products. As with service revenue you might want to separate revenue accounts for different goods. For example, if you are a grocer, you might have different revenue accounts for the sales of fresh vegetables and the sales of baked goods.

- Other Income: If your business has bank accounts, it will probably earn some interest. If you sell an asset for more than you bought it for, then you have a profit. “Other income” is a place to keep track of this kind of revenue, sometimes called “unearned income.”

- Operating expenses and expense accounts: Of course, you will have expenses associated with producing the goods and services that you sell. Operating expenses are expenses associated with operating the business. Typical operating expenses include:

- Salaries expense: Expenses associated with employees who receive a salary. Usually the owner’s salary is included in this account.

- Wages expense: Expenses associated with employees who are not salaried and receive an hourly rate of pay.

- Supplies expense: Expenses associated with supplies used during the month or year.

- Rent expense: Expenses associated with using a rented building or office.

- Utilities expense: Expenses associated with electricity, heat, water, and sewer used during the month or year.

- Telephone expense: Expenses associated with your telephone.

- Advertising expense: Expenses for advertisements, promotions, coupons, and other promotional items.

- Depreciation expense: Costs of long-term assets allocated to expense during the current month or year (typically you will need the assistance of an accountant to determine depreciation expense).

- Cost of Goods Sold (COGS): The Cost of Goods Sold is a special category of accounts that reflect those expenses that are directly related to making and delivering products to customers. Sometimes it is helpful to have accounts for each of the expenses that makes up the COGS, and sometimes it is better to aggregate it all into one account. The two main components of COGS are the cost of materials in producing a good and the cost of labor in producing and delivering a good. In general, a business needs to keep track of Cost of Goods Sold only if it carries inventory. You should consult with your accountant on the necessity for COGS accounts.

The accounts described above are common for many small businesses. The list does not include all possible accounts and you should consult with your bookkeeper and accountant to make sure you are keeping track of all your revenues and expenses.

Balance Sheet Accounts

A complete chart of accounts typically includes items from your balance sheet. The three categories of accounts on your balance sheet are assets, liabilities, and equity.

Assets include all your bank accounts where you keep cash, accounts receivable, current assets (things that you intend to sell or use during the year, like inventory), and fixed assets (things that last more than a year and depreciate, like vehicles, equipment, and furniture). Liabilities include accounts payable, credit card balances, current liabilities (things that you need to pay during the year, like quarterly taxes), and long-term liabilities (like long term loans). Equity accounts include net income (the amount of profit or loss for the year), retained earnings (the amount of all prior year profit or loss that is retained by the business), and owner’s equity (the amount of cash taken from the business by the owner or loaned to the business by the owner).

The importance of these balance sheet accounts depend on the size and type of business that you have. For more complex businesses, it will be important to get the assistance of an accountant to select which accounts are needed by your business and how to calculate the balances.

You can see the Chart of Accounts for Landscape Services LLC (PDF) here.

How to Track What is Important

It can be overwhelming to look at a Chart of Accounts and know how much detail is enough and how much is too much detail. Here are three guidelines to help you determine if something deserves its own accounting category:

- Do I care?

- Is it big enough to matter?

- Can I do anything about it?

Do I Care?

If you can’t think of any reason you care about what your different marketing expenses might be, for example, then there is no reason to get into too much detail. For example, you might not care about whether you were spending money on printing promotional materials online advertising, or another marketing activity. Double-check with your tax accountant to make sure they don’t care too!

Is it Big Enough to Matter?

Sticking with the marketing example, let’s say you would like to see how much you are spending on print advertising versus pay-per-click advertising online. But, when you look more closely at your spending habits, you only print out promotional flyers once a year and spend less than $100 on printing. So it isn’t really big enough to make a difference if you stopped spending on flyers. I define “big enough to matter” as the answer to the question “If I had to cut expenses dramatically, would cutting this make a difference to my profit?”

Can I do Anything About it?

There are some expenses that we can reduce by negotiating, shopping around for suppliers, or being frugal. And, there are others, like utilities, that we don’t have a lot of influence over. So, even if you were paying a lot for water and electricity, you probably can’t choose where you get your water and power. So it wouldn’t make sense to give these expenses separate accounting categories in the Chart of Accounts. I’d suggest keeping it simple and just calling them both Utilities.

Methods of Accounting

There are two main methods of tracking income and expenses - Cash Accounting and Accrual Accounting. These are two different ways of tracking and looking at how you earn and spend money in your business.

Cash Basis Accounting Method

Cash Accounting is the simpler of the two methods, reporting income when the cash (money) is received and expenses when they are paid.

When you look at your reports on a Cash Basis, you get a good understanding of how cash is actually deposited and distributed.

Accrual Basis Accounting Method

Accrual Basis Accounting is based on entering or reporting income when it is earned, even if it has not been collected (for example if you provide a service for which you send an invoice to be paid within 30 days, you would enter the amount you are owed on the day you provided the service). Similarly, expenses are entered or recorded when they are incurred, even if they have not yet been paid.

When you look at your reports on an Accrual Basis, you are looking at your earning potential (what you sold) and spending obligations, which can give you a better idea of what an average month should look like.

In the US, a business only files taxes on an Accrual Basis if they carry inventory or have more than $25 million in sales for three years.

Most bookkeeping software allows you to look at reports on both Cash and Accrual, but if you don’t use invoices or bills, your reports might look exactly the same.

For example, if you make a sale to a customer on terms, meaning they don’t have to pay you for a certain amount of time, you would enter an invoice to track the sale (income) and the Account Receivable. When the client pays, you would record a payment to show the Receivable had been paid. Between the time that the invoice is recorded and the customer pays you, your income is called Accrued Income.

Let’s say the invoice was recorded on September 30th and the client made payment on October 15th. If you looked at your Profit and Loss report on a Cash Basis, you would see the income in October, when the invoice was paid. If you ran the Profit and Loss on an Accrual Basis, the income would show in September, when the sale was made.

The same is true with expenses. If a vendor provided you with service and sent you a bill and you recorded that amount due as an Account Payable in August but actually paid the bill in September, Accrual Basis would show the expense in August. On a Cash Basis your income statement would show the money spent in September.

There may be some special considerations in managing your money through the transition between one tax year to the next and how best to account for income earned and expenses incurred in one calendar year but not paid until the next year. A tax accountant can help provide guidance in this area.

Keeping Business and Personal Money Separate

It is very important to keep your personal and business money separate. One of the first things you should do when starting a new business is to create a separate business bank account. It is ok to have a credit card in your name that you only use for business purposes, but you want to avoid using one credit card for both business and personal expenses.

It is important to remember that in many countries your business is a separate legal entity. One of the steps in establishing your business is to create and register a fictitious business name, or your “doing business as” (DBA) name (see the Licenses and Permits session in this course for more information). Even if your business name just adds the word “photography” or “construction” to your name, it allows you to create separate finances and accounts for your personal life and business. Your clients will then make payments to your business name, and an established name will help your business look more professional.

If you were to get investigated (audited) by an agency like the Internal Revenue Service (IRS) in the US, you are likely to have both your business and your personal finances examined. Any questionable deductions would probably be denied if you don’t have good separation and record keeping. Good accounting records are key to your financial success.

For expenses that are partially business use of personal resources, like auto mileage and home office, it’s important to understand how these deductions can be claimed. You should always pay these expenses in full from your personal account and reimburse yourself the deduction from your business, or have your tax accountant claim the deduction when you file your tax return.

Picking the right system for tracking income and expenses is important. What are you most likely going to stick with—pen and paper, Excel or Google spreadsheets, or an online software that talks to your bank? What will your accountant want from you in order to report and file your taxes or provide you with advice to keep your tax bill down? The better organized you are, the easier it will be for you and for your accountant to track your finances, and the more information you will have to run your business during the year.

If you decide to choose a bookkeeping software system, you want to keep these four things in mind:

- Cost. You need to balance features with cost. Some systems have a one-time price, others offer subscription pricing that you will pay each year.

- Growth and confidentiality. If you plan on hiring someone to help you with your bookkeeping, you need to be able to add them as users to your software, and you may want to be able to limit what they can see.

- Integrations. Your software should be able to automatically add transactions from your bank, but you may have other software you would like your accounting software to communicate with as well. These might include your customer relationship management (CRM) software, your payment processing software like Stripe, PayPal, Venmo, Zelle, etc., and others. Be aware that a lot of specialty softwares say they are accounting software or that they integrate with Quickbooks, but they can be limited or don’t fully integrate the way you expect. Make sure to get a demonstration from the software to see and understand how the integration will work.

- Recommendations. Make the decision with the help of your accountant. If your tax accountant is OK with you sending reports to them instead of inviting them into your software, you will have more choices. If they want to be able to see the detail directly in the software, you will likely have to go with whatever software they are willing to work with–probably Quickbooks.

Whatever you choose, make sure that you are comfortable with using the software!

You should be doing your bookkeeping at least once a month, ideally once a week.

Select Your Tax Accountant

There are two main types of tax accountants: an Enrolled Agent (EA) or a Certified Public Accountant (CPA). In the US, both are registered with the government and can file income tax returns on your behalf. A CPA has additional abilities for working with larger corporations that you likely won’t need. More important than the letters after their name is to find a good personality fit. And it’s always a good idea to check references and/or reviews.

Here are 5 things to look for when choosing a tax accountant

- Do they understand your business and your plans for the future?

- Are they willing to meet with you during the year, not just at deadlines?

- Are you comfortable asking questions and can they give clear explanations in plain language?

- Do they have a similar tolerance for risk as you do?

- Do they come highly recommended?

Your tax accountant doesn’t need to specialize in your industry, it is easy enough for them to look up current regulations. It is far more important to feel like your accountant is a trusted advisor in your business.

Select a Payroll Provider (if needed)

If you will be hiring people to help you with your business, it’s a good idea to hire a Payroll Service Provider (PSP) to help you pay them. A PSP will help ensure that you are paying all the appropriate taxes and fees through your payroll process.

As you grow your team you may choose to hire someone as a consultant or an employee, and the definitions and requirements for each can vary by region. Be sure you understand the differences where you will be operating your business to make sure you are following the law. See the Freelance, Independent, and Home-Based Businesses session of this course and the How To Start a Business and as an Independent Contractor blog for more information on this topic.

When selecting a payroll service, cost is only one of the important factors. Will they help you with the other expenses associated with having employees like Workers’ Compensation Insurance? Disability Insurance? Onboarding new employees?

If you have employees in multiple states or countries, how would that affect the pricing?

There are both standard payroll processing companies, PSPs as mentioned above, and Professional Employer Organizations (PEO). PEOs are more expensive and usually have a minimum number of employees but can get you access to better, more affordable benefits, and sometimes even help with some of the Human Resources functions like compliance training.

Start a Banking Relationship

Most small businesses think that all they need from their bank is someplace to hold the money they make until they need it. But, there is so much more available if you have a relationship with your bank. When your bank really gets to know you and your business needs, they can offer customized solutions to help you grow. A good banker can help you access credit, lower fees, and connect you to wealth management professionals. It is always best to begin the relationship before you need a loan so your bank can help you be ready if or when it makes sense to apply for a business loan. In the US, you will likely need a federal Employer Identification Number (EIN) to open your business account and you can get that for free on the Internal Revenue Service (IRS) website. See the Licenses and Permits session for more information about what might be required for your business.

Financial and Technical Assistance

Your bank may also be able to help you find funding and grant opportunities and technical assistance. Or, you can look to some of these well-known organizations to support you in your small business growth:

- The US Small Business Administration (SBA).

- Service Corps of Retired Executives (SCORE), which is a nonprofit organization whose goal is to help small businesses become successful. SCORE offers workshops and seminars on various business topics and may give you the opportunity to talk to someone who has business experience.

- Local community organizations and business development centers.

- Trade organizations.

Congratulations! It is time to get started with your business. As you begin your work of selling and servicing clients, here are some additional “best practices” to keep in mind.

Internal Controls

Internal controls are the policies, processes, and procedures you set up for your business to avoid mistakes, fraud, and wasted resources and to ensure the accuracy of the financial reports produced.

It isn’t enough to earn a lot of money if you aren’t collecting it or if you don’t know how it is being spent and if it is being spent properly. No one person, even the owner, should have control over all parts of a financial transaction. There should always be a second set of eyes to help review transactions for accuracy.

How can you make sure mistakes aren’t being made? Here are some things to consider:

- Divide up responsibilities. The person who deposits money should not be in charge of recording deposits or if they are, they should be double-checked by your accountant or bookkeeper through the reconciliation process (the process where you compare your reports with your bank account).

- Regularly review your bank and credit card statements to see if there are transactions you can't explain.

- Restrict access to cash and inventory to make sure things don’t go missing.

- Decide who has the authority to order supplies, receive goods, and pay bills in your organization and who will double check their work.

Dishonesty is far too frequent, and honest mistakes are even more frequent. The best way to make sure things don’t go wrong is to have safeguards in place as soon as possible. By setting up the controls and systems now, it will make it easier to assign responsibilities with less stress later on.

Working with a Hired Bookkeeper

Most business owners want to do their own bookkeeping to save money when they first start their business. Since you are the one earning and spending the business money, this is a great idea… as long as you know what you are doing or get some training to do it the right way from the start. At some point, however, you are going to get busy and your time will be better spent on getting new customers and keeping them happy. Bookkeeping is one of the easiest things to delegate to a professional if you know how to read your reports.

It is important to ask your bookkeeper what they need from you in order to correctly record transactions, and how many days they will need to process (reconcile) the previous month and send you reports. While a license is required to be an accountant, there is no formal professional requirement to be a bookkeeper. So be sure you check references and reviews before hiring someone, and always review all the work done to make sure it makes sense to you and your accountant.

Bank Account Reconciliation

This process is important because it ensures that you can identify any unusual transactions caused by fraud or accounting errors.

Reconciling is a process that you can do on paper or in your accounting software to compare your own financial transactions to the monthly statement provided by your bank or credit card company. Reconciling is important because it ensures that you can explain any difference between what your software has as the “book balance” to what the bank has as the “bank balance” as of a certain date. It is important to do this monthly to make sure you are always up to date and to catch any errors. Reconciliation will also help you avoid making payments that exceed your available money (known as “bouncing” payments) because you forgot about a check you wrote. When you can explain any difference between your “bank balance” and your “book balance” then you are reconciled. Do be aware that if a transaction still hasn’t cleared after 30 days, there may be a problem and you may have to reissue the payment or verify it wasn’t entered twice into your software. You are checking to make sure you have recorded all the transactions that cleared your bank and to make sure there aren’t any outstanding transactions, like checks that haven’t been cashed.

Tax Liability Issues

Your business’s tax liability depends on the country, state, county, and city in which you operate. Below we discuss the taxes that are common for a business operating in the US: the Income Tax, Payroll Tax, and Sales Tax.

There are several kinds of taxes that you will be responsible for paying. Some of the taxes, like sales tax, you will collect from others and pay to the government. Others, like your Income tax, will be based on your business activity. We refer to these as Liabilities since it is something you owe out but haven’t paid yet. Your tax accountant can help you stay in compliance (understand your financial responsibilities for these and make appropriate payments within any required schedules) with all the various taxes and their due dates.

Income Tax

Income tax is the money you owe based on the Net Income (income minus expenses) of the business. You may also owe Unincorporated Business Tax on your earnings the amount that would have been paid into Social Security had you been paid through payroll. Be sure to talk to your tax accountant about how much to set aside to save for taxes 15% of income less inventory is a good place to start.

If you owe more than $1,000 in Income Tax for the year, you will likely be required to pay Quarterly Estimated Income Tax payments. Your accountant can help you determine if you will need to pay these quarterly taxes and their due dates. You can also request the paperwork from the IRS to submit these on your own.

Payroll Tax

If you have employees, you will need to get set up to collect and pay payroll taxes. This is another reason it’s a good idea to hire a PSP. If you haven’t already gotten an Employer Identification Number (EIN) to open your business bank accounts, you will need to do that now. You can apply online for free on the website for the Internal Revenue Service (IRS). You likely will also need a state identification number. Your PSP or your tax accountant can help you apply for that number.

Disability and Workers’ Compensation are additional costs to running payroll. These aren’t taxes but insurance expenses, so your PSP may not take care of paying these for you. Be sure to work with someone who understands all the payroll requirements for your location.

Sales Tax

You should register for a sales tax license before you begin to sell and collect sales tax from customers. You can usually register online with the state’s Department of Revenue to get your permit. (See the Licenses and Permits session of this course for more information.)

Each state and county makes its own rules when it comes to sales tax. If you do business in multiple states, don’t assume the rules for collecting or filing are the same. The frequency and due dates might be different as well.

Generally speaking, you only need to collect and file sales tax in states where you have “nexus.” Nexus is a fancy way of saying that you have a business activity in a state.

Things that could give you nexus include:

- Being an ecommerce business.

- Having a physical location like a warehouse or storefront.

- Employees or affiliates.

Sales tax can be really confusing so be sure to get the support you need to stay on track and out of trouble.

A note on VAT …

The United States, unlike many other countries, does not have a Value-Added Tax (VAT).

VAT works like a sales tax in that it is an additional amount added to the cost of products and/or services, based on a percentage. One difference between a sales tax and a VAT is that VAT is usually determined by the government of a whole country rather than by local government, like sales tax in the USA. Some VAT taxes have both a federal and provincial component.

For example, if a product or service cost $100 and there is a 5% VAT, then the customer would pay the merchant $105. The merchant would keep $100 and save and remit the $5 to the government.

In some countries, the merchant or business owner may deduct the amount of VAT paid against the amount of VAT collected before remitting to the government. It is important to know the regulations for your location and have a good system to track what you have collected and paid so you are remitting the correct amount to the government.

In this session, you learned how to organize yourself and your business to keep good financial records by using a method that works for you, whether it’s pencil and paper, spreadsheets, or integrated accounting software to automate and streamline your transactions. You learned about three standard financial reports Balance Sheet, Profit and Loss Statement, and Statement of Cash Flow how to organize, read, and understand them to gauge the health of your business. If you have decided on and started using the software of your choice, hopefully you have also customized the Chart of Accounts to your liking.

You have learned some of the different accounting professionals who can help you when you have questions and give you guidance to make sure your systems are set up correctly and maintained.

Now, all there is left to do is to go do it! Whether you plan to do your own bookkeeping or hire someone to help you, remember that this is your business and you should always gut-check the advice and direction given to you by others to make sure it aligns with your plans for the future.

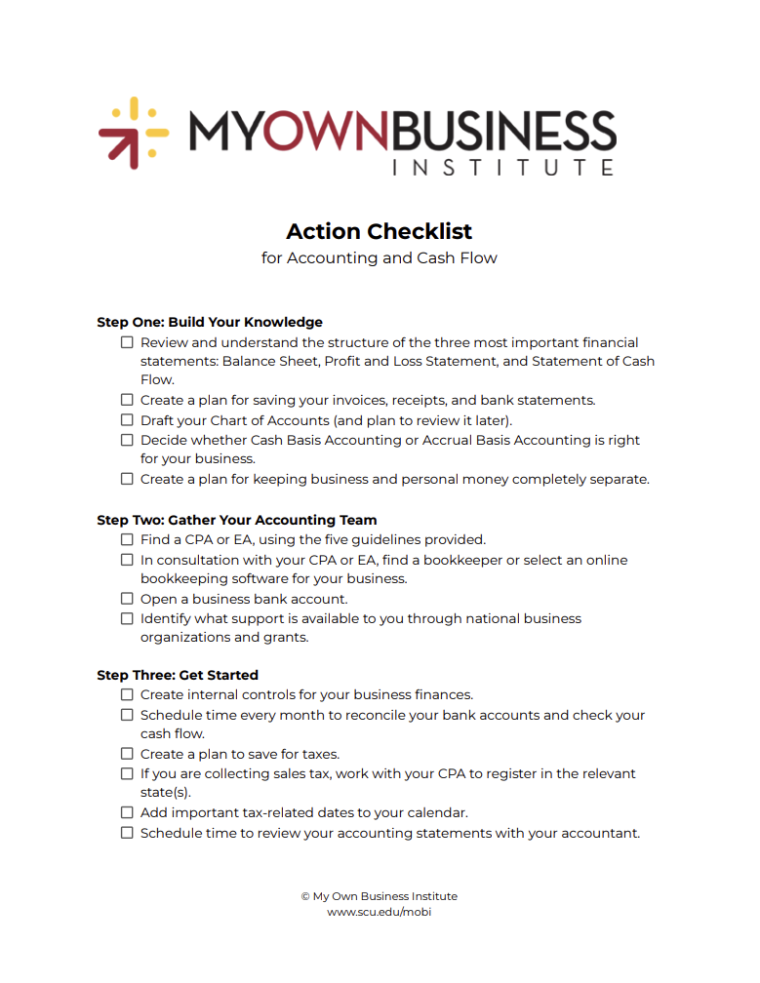

Accounting and Cash Flow Action List:

Download the Action Checklist for Accounting and Cash Flow (PDF).

THE TOP 10 DO'S

- Separate out your business spending from your personal spending right away.

- Review and reconcile your bank statements each month to make sure your bookkeeping is accurate.

- Keep all receipts and bank statements for at least three years.

- Take responsibility for knowing tax deadlines and making sure you make timely payments.

- Make sure your accounting team is able to take the time to talk with you and answer all your questions.

- Be intentional about spending money. Only spend when the expense will almost certainly bring you in new money in the next 30 to 90 days.

- Set aside a percentage of your earnings into a savings account to build up an emergency and growth fund with at least three months’ worth of operating expenses. Start with just 1% and try to increase to 10%.

- Pay yourself! You should be taking home approximately 25% of your business income.

- Get your business team (accountant, bookkeeper, and peer mentors) together and meet regularly for support and accountability.

- Set achievable goals for yourself and remember that you define what success looks like for you.

THE TOP 10 DON'TS

- Get discouraged if you don’t do it perfectly. Learning new things takes time.

- Ignore your intuition. If something doesn’t feel right, get more information.

- Allow others to take advantage of you and don’t mistreat those who support you.

- Assume that because something worked for someone else that it will automatically work for you.

- Try to do it all yourself. Stay in your “zone of genius” and ask others to help you with the rest.

- Avoid responsibility - your business belongs to you and no one else will take as good care of it as you will. Delegate only when you can evaluate and manage others.

- Wing it. Yogi Berra said “Without a plan, even the most brilliant business can get lost.” Make sure you know where you want to go so you can make sure that is the direction you are headed.

- Spend the money you have saved for taxes—that isn’t your money it belongs to the government.

- Wait until the last minute to do your bookkeeping or file your taxes.

- Underestimate the amount of time and money you will need to start your business. Make sure you have adequate resources and a backup plan.

If you are writing your business plan while reviewing this material, take a moment now to include any information about your business related to this session. MOBI’s free Business Plan Template and other worksheets, checklists, and templates are available for you to download. Just visit the list of MOBI Resource Documents on the Resources & Tools page of our website.

Here are some key terms and definitions used in this session or related to this session:

| Term | Definition |

|---|---|

| Accountant | Also known as a professional accountant or tax accountant, the person who gathers information from the bookkeeper to create financial statements, prepare tax reports, and file taxes on behalf of the business. |

| Accounting | Accounting refers to the bigger picture, where your financial transactions and financial information are combined in standard reports or financial statements. These standard reports help you (as well as partners, lenders, advisors, and other stakeholders) understand the financial health of your business so you can make wise financial decisions. |

| Accounts Payable | The money owed by a business to its suppliers, providers, vendors, or others, in other words, the bills a business has to pay. Accounts payable is listed as a liability on a Balance sheet. Sometimes abbreviated as A/P or AP. |

| Accounts Receivable | The money that is owed to a business by its customers. Accounts receivable are listed as an asset on a Balance Sheet. Sometimes abbreviated A/R or AR. |

| Accrual Basis Accounting | A method of accounting where income is entered when it is earned, even if it has not been collected and expenses are entered when they are incurred, even if they have not yet been paid. |

| Assets | The resources owned by or owed to the business (typically include cash, accounts receivable, current assets like inventory that has not been used yet, fixed assets like equipment, etc.). |

| Balance Sheet | Shows how much the business is worth, including everything others owe to the business (assets), everything the business owes to others (liabilities), and everything the business owns (equity). |

| Bank Balance vs Book Balance | The bank balance reflects the actual funds in the bank account according to the bank's records, while the book balance represents the financial position as recorded in the business's accounting system, which may include additional information and adjustments. |

| Bookkeeping | Bookkeeping refers to the activities involved in tracking individual financial transactions. Bookkeeping presents the business owner with clear, accurate financial statements. Bookkeeping is the basis of accounting. |

| Cash Basis Accounting | A method of accounting where income is reported when the cash (money) is actually received and expenses are reported when they are actually paid. This is the simplest of the two accounting methods. |

| Chart of Accounts | The Chart of Accounts is a list of all of the accounting categories you will use to record how you earned, spent, moved, and kept your money. |

| Cost of Goods Sold (COGS) | A special category of accounts that reflect those expenses that are directly related to making and delivering products to customers. Two main components of COGS are the cost of materials in producing a good and the cost of labor in producing and delivering a good. |

| DBA | Doing Business As, or the name under which you will operate your business. Also known as a fictitious business name. A DBA or fictitious business name can help establish your business as a separate legal entity. You may be required to file your fictitious business name with your local city government depending on the laws in your area. |

| Deduction | An amount of money that can be taken out from taxable income. Laws regarding deductions can be complicated, especially if you operate your business from your home, and it's a good idea to consult with a tax accountant about what you can and can't deduct as a small business owner. |

| Depreciation | The practice of decreasing the value of an asset over its useful life for accounting and tax purposes. |

| Equity | The difference between the assets and liabilities, is basically how much a business is worth. Calculated on a Balance Sheet. |

| Income Statement | Also known as the Profit and Loss Statement or P&L, shows how your business earned and spent money, and if the business is profitable or not. |

| Internal Controls | A set of policies, procedures, and practices created within a business to protect assets ensure accuracy and reliability of financial reporting, and promote compliance with laws. Internal controls are important for preventing fraud, mistakes, and misstatements. |

| Liabilities (with regard to accounting) | The resources/money owed by the business to others (typically include accounts payable, credit card balance, current liabilities like quarterly taxes, long-term liabilities like loans, etc.) |

| Net Income | The amount of money a business makes after you take out the costs and expenses. |

| Nexus | A term used in accounting to refer to the presence of a business in a specific state, country, region or jurisdiction. A nexus may trigger certain tax obligations, so it's important to understand the laws in your business location(s). |

| Operating Expenses | Operating expenses are the ongoing costs and expenditures necessary to maintain and run the day-to-day operations of the business. These can include salary expenses, rent expenses, utilities expenses, advertising expenses, depreciation expenses, and others. Operating expenses are sometimes abbreviated as OpEx. |

| Profit and Loss Statement (P&L) | Also known as the Income Statement, shows how your business earned and spent money, and if the business is profitable or not. |

| Statement of Cash Flow | The Cash Flow Statement summarizes the movement of cash and cash equivalents (like credit card and loan payments) that come in and go out of the business. The Cash Flow Statement measures how well a company manages its cash (money) and if the company generates enough cash (money) to pay its operating expenses and debts. |

| VAT (Value-Added Tax) | VAT works like a sales tax in that it is an additional amount added to the cost of products and/or services, based on a percentage. One difference between a sales tax and a VAT is that VAT is usually determined by the government of a whole country rather than by local government, like sales tax in the USA |

Enroll Now

View Sessions by Course

View Sessions by Topic

FOLLOW MOBI ON SOCIAL MEDIA

Featured Video: How to Create an Income Statement for your Business originally appeared on BusinessTown