OVERVIEW:

Obtaining the proper licenses and permits when you are starting your own business provides several benefits. Licenses and permits ensure that you are operating your business legally for your location, your industry, and your business entity. Licenses and permits can help you attract customers, suppliers, partners, or investors by demonstrating your business is official and legal. By understanding the specific licenses and permits required for your business, you can operate confidently and compliantly from the start. While this session provides general guidelines, MOBI does not provide legal advice, and it is recommended that you consult with an attorney specializing in business law to ensure you meet all legal requirements.

- Do I Need Licenses?

- Factors that Determine Licenses and Permits

- Business Entity or Legal Structure

- Location

- Type of Business

- Buying an Existing Business

- Licenses All (or Most!) Businesses Need

- Business Tax License/Business License

- Fictitious Business Name/DBA

- Tax Identification Number: SSN, ITIN, or EIN

- Additional Requirements Depending on Your Business

- Home-Based Businesses

- Food Businesses and “Cottage” Food Businesses

- Licenses for Home-Based Care Businesses

- Seller’s Permit/Sales Tax Permit

- State Licenses

- County Permits

- Police and Fire Departments

- Federal Licenses and Permits

- Where to Get Permits and Licenses

- Licenses and Permits Checklist

- Top 10 Do’s and Don’ts

- Business Resources

Watch this session in video format. (37:46)

Every business owner will need at least one license: a business tax license, or more simply known as a “business license.” There may be other licenses and permits that are required. It’s important to research the licenses and permits you will need before you start the process of starting your business. As you research, create a list of licenses and permits needed including the different requirements, the cost to obtain each one (some are free), and the term, or length of time before it needs to be renewed. This can help you plan your timing and budget.

There are several benefits to having all your licenses and permits. Some of these include:

- Operating your business legally from the start.

- Building trust with customers, suppliers, partners, and investors.

- Obtaining business insurance.

- Pursuing loans, funding, and/or grants.

- Establishing yourself as an independent contractor.

- Applying for larger business opportunities and contracts.

- Protecting yourself and your business (since some licenses and permits require regular inspections).

Generally, all permits and licenses required to operate your business can be obtained through local government offices and at the state level. There are specific businesses for which a federal license might be required, and those are listed later in this session.

The specific licenses and permits you need depends on a number of factors. You may also be required to obtain special certifications and/or licenses before you can get the appropriate permits to start your business. The process of obtaining permits is known as “pulling permits.”

Key factors that determine licenses and permits you need include:

- Legal structure or entity (sole proprietorship, partnership, etc.)

- Location where you will be operating your business (city, state, county, etc.)

- Type of business or industry

- Buying an Existing Business

For many businesses, issues regarding licenses, permits, and business names can be handled on your own, some other businesses may require the help of a lawyer. So before you start, it's a good idea to identify a lawyer whose practice is focused on business. A good way to find a lawyer is to ask for recommendations from your accountant or business acquaintances. If you're not sure about an issue, ask your lawyer about it first. Your investment in legal fees now can help you avoid much bigger problems at a later date. As stated earlier, this session provides general guidance and not legal advice, so it’s always a good idea to check with an attorney for legal questions. Your local government or the U.S. Small Business Administration’s Small Business Development Center (SBDC) in your location might offer free legal services for small businesses or be able to direct you to a resource for information.

Legal Structure or Entity

The legal organization or entity you choose for your business will determine the licenses and permits required. The most common legal entities include: sole proprietorship, partnership, Limited Liability Company (LLC), (either single member LLC or partnership LLC), corporation, S-corporation (S-corp), benefit or social purpose corporation, and nonprofit.

Many new business owners choose to operate as a sole proprietor, with LLCs, and S-corps following in order of popularity. A sole proprietorship can typically be formed without an attorney. An LLC or corporation will likely require an attorney, accountant, or a business professional to assist. Some local governments partner with nonprofit organizations to provide assistance.

There is also a C-corporation (C-corp), but this is generally for much larger businesses that are owned by shareholders and anticipate growth through stock sales, etc. It is highly unlikely that a small business owner would choose to operate as a C-corp when starting their business.

Visit MOBI’s session on Business Organization to learn more about the different types of legal entities and the pros and cons of each one.

Location

Regardless whether you operate a business from your home, from your phone, or in a physical space (known as a brick and mortar business), your business location is a factor in determining your licenses and permits because areas are designated for specific uses. This is known as zoning. Some general zone categories include: residential, commercial, industrial, mixed-use, special purpose, conservation, and historic preservation. You will need to verify that your type of business is allowed in your location, this is known as being in compliance with zoning.

If your type of business is not allowed in your area, you may be able to apply for a variance, to get approval. Your local government can provide the steps for this process, and it will likely include a fee.

You will be required to provide a business address when obtaining your licenses and permits. It’s important to remember that the address of your business is public information. If you are operating your business from your home and would like to keep your address private, you can purchase a business address using a virtual office service or a mailbox provider such as the UPS Store. Certain government agencies will not allow PO boxes as official business addresses. Therefore, it is best to use a virtual office or the service of a UPS Store mailing address.

Type of Business

The type of business you plan to start and the industry will also determine the licenses and permits you will need. A hair stylist and electrician will need special certifications and training to start their own businesses, whereas a web designer may just need to obtain a business tax license. This may also vary depending on your location.

Buying an Existing Business

Entrepreneurs who are purchasing an existing business may have a different process in obtaining licenses and permits. When buying a business be sure that you understand all of the licenses and permits that are required, whether any have expired, and how you will ensure you are compliant with all of the legal requirements for the business.

Generally, it is recommended that you go through escrow to purchase a business. Going through escrow means you would work with a neutral third party to manage the transaction, rather than making the purchase directly from the seller. The neutral party, or agent, holds the purchase funds securely until all terms of the sale agreement are met by both the buyer and seller. This process helps ensure the safety and fairness for both parties involved in the transaction. It is not illegal to purchase a business without escrow, but you take on significant risk in doing so.

For details, please visit MOBI’s Buying Businesses session to learn more.

Business Tax License/Business License

Every business owner needs a business tax license, also known as a business license, in order to operate a business legally. This license is typically provided by your local government for a fee and it must be renewed each year.

First, as mentioned earlier, you will need to verify that your type of business is allowed in your location. This is also known as being in compliance with the zoning of your location. Zoning refers to local government regulations that designate specific areas for different types of land use, ensuring businesses operate in permitted locations.

If you are in compliance with zoning, you may go ahead and submit for a business tax license. The business tax license fee amount will depend on your location, business type, and maybe also number of employees (if any), revenue, or additional factors. After you pay your license fee, you will receive a license with an associated business license number. It’s a good idea to have this number handy in case it’s required for forms or applications in the future. Also be sure to keep your business license in a safe place, and some industries may require that you display it at your business location.

It’s important to note that this license does not mean that you have met all the license and permit requirements for your business. The business tax license verifies that your local government is aware that you are operating your business in your location.

Fictitious Business Name/DBA

What's in a business name? Plenty. Not only must your name reflect your brand and be memorable, there are also a host of legal issues to consider. Before you take those steps, you will need to choose your business name. The U.S. Small Business Administration provides some helpful information on their webpage: Choose Your Business Name . You can also visit MOBI’s Marketing session to learn more about branding your business.

Depending on your business name and your business entity, and whether you have one business name for your bank and another for marketing and advertising, you may need to file a fictitious business name, or “Doing Business As” (DBA) name. A fictitious business name is used when a business operates under a name that is different from its legal name or the name of the owner(s). So the legal name you decide to give your business is known as your fictitious business name or the name you are Doing Business As.

Do you need to have a DBA? The answer is probably "yes," and you definitely want to take the time to find out. Most states require that you get a DBA.

If you are a sole proprietor, you will register your business name with the county, this may be through the County Recorder’s office or the County Clerk’s office. This step is called registering or filing your fictitious business name. This is not required for corporations or LLCs, unless the name of the business is different from the name you use in marketing. Similarly, if you are an LLC or corporation operating with a different name than what was registered with your state, then you too will need to register your fictitious business name with the appropriate county office.

For example, if your corporation name is ABC Corporation, but you are marketing yourself as 123 Company, then a DBA would be needed. It would be ABC Corporation, Doing Business As (DBA) as 123 Company.

To register your fictitious business name, go to the appropriate county office and fill out the DBA form. Be sure to search the name you want for your business ahead of time so that you don’t choose something already used by another business. All counties will have a search function on names of businesses.

You will also want to prepare the information you will need for your form. This may include: the business name, the business address, the business organization/entity, owner information (name, home address, phone number, email address), nature of business, and identification such as a photo ID. You will also likely need to pay a filing fee.

In some counties you will need to publish your name in a local publication within 30 days of filing your fictitious business name/DBA. This serves as the official notification to the community and stakeholders that the business is operating under a specific name and ownership structure. This also helps protect customers and creditors by providing information of who owns and operates the business.

Here are some important benefits of establishing a DBA:

- You can sign and enforce contracts under your business name.

- You can operate and advertise under your business name.

- You can prevent other businesses from using the name within your state.

- You can establish a separate bank account under your business name.

- You can accept checks written out to your business name.

- You can gain a more professional image.

- You can establish yourself as a formal business if you are a consultant or independent contractor.

You will not be able to enforce any contracts you sign under your business name unless the name legally belongs to you. You will have to register your Fictitious Business Name/DBA every 5 years.

Banking Under Your Business Name

The vast majority of banks will not allow you to open a business bank account unless you have shown them proof of a filed DBA. It is important to have a business bank account so that you can accept payments written out to your business name. You may consider checking with different banks to see the differences in services they will offer you and the requirements they have to set up a business account.

Should I Trademark My Business Name?

You are not required by law to do this but registering your name as a trademark is always a good idea. It provides you with protection in case another business tries to use your business name or a name that is likely to be confused with your business name. It may be smart to file an application for a federal trademark if your company is doing business in several states. Run a search with the government or through a service to determine if your name is taken. You can also find more information through the U.S. Patents and Trademark Office: www.uspto.gov.

Tax Identification Number: SSN, ITIN, or EIN

In the U.S. there are three tax identification numbers that can be used for tax and business purposes. These include Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), and Employer Identification Number (EIN). We recommend that all businesses get an EIN, even if you have a SSN or ITIN, because it helps protect your privacy and personal tax identification number.

You are required to use one of these numbers for your business. Your tax identification number will be requested when you are applying for permits and licenses, opening bank accounts, accepting credit cards, and more.

Here we describe the differences for your information, and again recommend getting an EIN for your business.

Social Security Number (SSN): Typically sole proprietors who do not have employees and do not operate as a separate entity (like LLC, corporation, partnership, nonprofit, etc.) can use their SSN for their personal tax returns and business income.

Individual Taxpayer Identification Number (ITIN): Individuals who are not eligible for a SSN but need to file taxes with the IRS can use their ITIN number. These are generally used by non-resident individuals, foreign nationals, and others who need to comply with U.S. tax laws but do not qualify for a SSN.

Employer Identification Number (EIN): Businesses are required to use an EIN number rather than a SSN or ITIN in certain circumstances. It can also be a good idea to use an EIN even if you don’t need to because it can be safer to give out rather than your personal SSN or ITIN. Another benefit of having an EIN is that it can help establish credibility with whom you do business.

An EIN is required for your business if:

- Your business has employees.

- Your business is an LLC, partnership, or corporation.

- You file business taxes such as: corporate income tax, partnership tax, employment tax, excise tax, or taxes associated with businesses related to alcohol, tobacco, and firearms.

- You withhold taxes on income, other than wages, paid to a non-resident individual.

- You have a Keogh plan (a type of retirement savings plan designed for self-employed individuals and small business owners).

- You are involved with: trusts, IRAs, exempt organization business income tax returns, estates, real estate mortgage investment conduits, nonprofit organizations, farmers' cooperatives or plan administrators.

In addition, you may be asked to provide an EIN for certain business bank accounts and/or licenses and permits.

How do I apply for an EIN?

Fortunately, the Internal Revenue Service (IRS) makes it very easy to apply. Whether you have an SSN or ITIN, you can apply for an EIN, free of charge on the IRS website. You can apply by phone, fax, mail, or online. Vist this IRS website for more information IRS - Employer ID Numbers (EIN) - How to Apply .

The next steps in opening your business may differ depending on your entity, your location, your business industry, where you operate your business, and more. Here are a few examples, and you can check with your local government office to research the licenses and permits needed for your specific business.

Home-Based Businesses

Some residential neighborhoods have strict zoning restrictions that may prevent you from doing business out of your home. As mentioned earlier, zoning requirements will impact the types of businesses that can be operated from your home. Some types of businesses may be required to operate within commercial or mixed-use zoning areas rather than residential areas. However, it may be possible to get a variance or conditional-use permit to get approval to operate your business. In many areas, attitudes toward home-based businesses are becoming more supportive, making it easier to obtain a variance. Condominiums and planned communities may have bylaws that could affect your ability to do business out of your home.

If your business generates heavy traffic, causes noise or pollution, requires special permits, involves hazardous materials, affects property values, operates outdoors, or conflicts with neighborhood character, you may not be allowed to operate in a residential area. For example, a nail salon may not be approved for a home-based business. Other special circumstances might exist, such as those in a designated historical district.

Home-based businesses involving food sales are restricted, and you will need to understand the laws in the state or location from where you operate your business if you are pursuing a food business. Most home-based businesses are not allowed to sell food from home. Those that are allowed have restrictions such as how much revenue they can generate per year, the type of food sold, etc. The health department in your city or county will have additional information if this type of business is allowed in your location. We provide more information about food businesses next, and you can also refer to MOBI’s Freelance, Independent, and Home-Based Business session for more information and guidance for starting a business from your home.

Food Businesses and “Cottage” Food Businesses

If you plan to operate a food business, it’s important to understand all the requirements for your specific business and your location. Examples of food businesses can include restaurants, food trucks, food carts, street vendors, catering businesses, home-based food businesses, and cottage food businesses.

A cottage food business is a type of small-scale food business where individuals prepare and sell homemade food products from their own homes. These businesses are often subject to specific regulations and permits that allow them to operate without needing a commercial kitchen. The types of food allowed and the regulations can vary by state, but typically include non-perishable items like baked goods, jams, and candies.

Examples of specific licenses and permits required for food businesses can include:

- Food Handling/Food Safety Requirements: In addition to a health department permit, a food handlers permit may be required to ensure you and any employees of your business receive specific certification or training for the food you are preparing for your business. This certification or permit demonstrates knowledge and competency in handling food safely to prevent contamination. Food handling permits are often required for food handlers, cooks, chefs, and other personnel involved in food preparation.

- Commercial Kitchen Requirements: Depending on your location, you may be required to prepare your business’s food in a commercial kitchen that meets health department standards. Business owners can rent a commercial kitchen space in their area to prepare their food. You may also be able to rent time in a commercial kitchen shared with others, if your hours are limited or you want to reduce costs. Alternatively, some areas allow home-based businesses to operate under specific conditions, such as obtaining a home kitchen inspection and permit.

- Labeling and Packaging Requirements: Health department regulations may also include requirements for labeling and packaging of food products, including allergen information and expiration dates.

To determine the specific requirements for selling food products in your area, it's important to contact your local health department or regulatory agency. They can provide guidance on the necessary permits, inspections, and regulations that apply to your business. Compliance with these regulations helps ensure the safety and quality of the food products you sell to customers.

Licenses for Home-Based Care Businesses

Individuals may wish to operate a daycare business for children or an adult care business for elderly or disabled individuals. In both of these cases there are special licenses and permits that are required, and it’s important that you understand the laws in your area. For example, in California, business owners operating a care business must obtain a license from the California Department of Social Services (CDSS), Community Care Licensing Division. There may be specific requirements and regulations depending upon the number of individuals in your care and the ages of children, if it is a child care facility. For elderly care businesses, you may also need a Residential Care Facility for the Elderly (RCFE) License for non-medical care of elderly residents. This is applicable for home-based facilities that provide room, board, and assistance with activities of daily living.

You will need to verify that your zoning allows for care businesses in your location. Your home will also need to be inspected to ensure it meets the health and safety standards, including proper sanitation, safety features, and emergency preparedness.

Lastly, care businesses are also required to undergo background checks and fingerprinting for owners, administrators and staff.

Business owners pursuing these home-based businesses should check with both your local city and/or county and state governments for the most current and specific requirements for your business. It is your responsibility as a business owner to ensure you keep up with changes to requirements.

Seller’s Permit/Sales Tax Permit

Businesses typically need a seller’s permit, also known as a sales tax permit or sales tax license if they sell tangible (physical) goods or certain services that are subject to sales tax in their location. The requirement varies by state and locality, but does apply whether you have a home-based business or brick and mortar, and for all business entity types. This permit is generally free or low cost.

You will need a seller’s permit if you are selling items such as:

- Clothing that you made

- Clothing that you purchased to resale

- Food that you made to resale

- Items that you produced, either yourself or through a manufacturer or wholesaler

As mentioned, you may also need a seller’s permit if your business sells certain services. These requirements may differ by state or location but could include services such as:

- Event planning services, if you sell tangible items (like decorations) as part of your service package

- Landscaping services, in some states, if they involve the sale of tangible items such as mulch, plants, etc.

Remember, you are required to collect sales tax on behalf of the government. It is common for small business owners to get confused and feel the money they receive through sales is their revenue. To avoid mistaking collected sales tax for revenue, it’s a good practice to open a separate bank account for sales tax. Each week, transfer the collected sales tax into this account. When it is time to file your sales tax report and send the payment, the funds will already be set aside and organized.

A seller’s permit allows you to shop at wholesale stores/vendors, which generally offer products at a lower cost allowing for a greater profit margin. Additionally, when purchasing from wholesalers, you will be charged sales tax just as you will charge your end customer.

Where do I get a seller's permit? You can register for a seller's permit through the state's Board of Equalization, Sales Tax Commission, or Franchise Tax Board. The following is a useful link from the IRS website to help you locate the appropriate offices in your state: IRS.gov - State Government Websites .

State Licenses

Some businesses require you to have a special state license in order to operate. These are generally obtained by taking an exam, passing it, and being issued a license to operate.

This includes, but is not limited to:

- Accountants

- Appraisers

- Auctioneers

- Barbers

- Bill Collectors

- Brokers

- Building Contractors such as:

- Roofing

- Plumbing

- HVAC

- Electrical

- Landscape Construction

- Cosmetologists

- Private Security Guards

- Private Investigators

- Real Estate Agents

Your state may require you to have special licenses if you sell certain products such as firearms, gasoline, liquor, lottery tickets, etc. You can check with your local and state government to see if your business will require any special licenses.

County Permits

County permits can vary widely depending on the location and the specific regulations set by the county government. Here are some common types of county permits:

- The County Health Department Permit: Certain businesses, such as restaurants, food trucks, street vendors, and childcare or adult care facilities, may require a health department permit from the county to ensure compliance with health and safety regulations. You will need a health department permit if you plan to sell food and manufacture food. It involves an annual inspection, and the permit must be renewed each year.

- Building or Construction Permit: If you are planning to construct, renovate, or make significant changes to a building or property within the county, you may need a building permit or construction permit to ensure compliance with building codes and regulations. Be sure you understand the building codes so you know what permits you might need. Also, check with your local government to see if there are any grants or funding opportunities to support small business improvement projects.

- Alcohol License: Businesses that sell or serve alcoholic beverages, such as bars, restaurants, and liquor stores, may need an alcohol license or permit issued by the county's Alcohol Beverage Control Board.

- Signage Permit: If you plan to install signage for your business, such as outdoor signs or billboards, you may need a signage permit from the county (or city) to ensure compliance with local regulations regarding size, placement, and aesthetics. In some cases if you are replacing a sign of the same type and dimensions, you may not be required to get a permit. Be sure to check with the local government to understand the requirements.

Police Department

Sometimes, you will need permission from the police department in order to conduct your business. Certain industries require police department approval before the city grants you permission to operate. Additionally, if you plan to sell late into the night or work as a food peddler, police involvement may be necessary. Always check with your local police department for specific requirements.

Some examples of these types of businesses include, but are not limited to:

- Nightclubs and bars

- Adult entertainment establishments

- Event venues

- Pawn shops

- Businesses with high security risks

Fire Department

The fire department is generally needed for two primary reasons, though there may be others. One reason is to conduct an inspection of a fire sprinkler system, and another is to inspect restaurant exhaust hoods. The fire department can also determine the maximum capacity your establishment can hold safely.

Federal Licenses and Permits

For a very small number of businesses, federal licensing is a requirement. In businesses that are highly regulated by the government, federal licensing is typically required. Examples include but are not limited to:

- Broadcasting

- Drug Manufacturing

- Ground Transportation

- Investment Advising

- Manufacturing Tobacco, Alcohol, or Firearms

- Preparing Meat Products

- Selling Firearms

The best place to start is your local city hall or courthouse. See the City Clerk, who should be able to direct you. You can also phone the city or County Recorder’s or County Clerk’s office with questions, or look in your local phone book under municipal government offices. Try a search online for "Your city hall" to find the web site for your local city hall.

Here are some of the website links that have been provided in this session:

- U.S. Small Business Administration How to Choose and Register Your Business Name

- U.S. Small Business Administration Apply for Licenses and Permits

- U.S. Small Business Administration Small Business Development Center (SBDC)

- U.S. Small Business Administration Get Federal and State Tax ID Numbers

- U.S. Patent and Trademark Office https://www.uspto.gov/

- U.S. Internal Revenue Service (IRS) How to Apply for an EIN

- U.S. Internal Revenue Service (IRS) State Government Websites

- California Department of Public Health Certificates, Licenses, Permits, and Registration

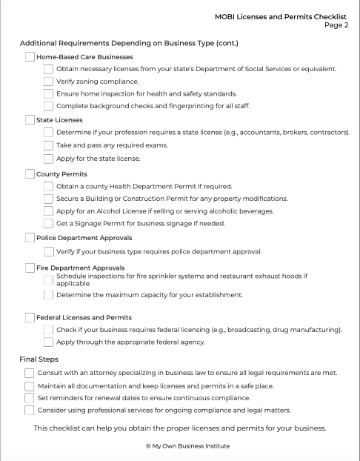

Here is a checklist that you can download to help ensure you have the permits and licenses you need for your business. Again, it’s a good idea to check with your local government and/or business lawyer to make sure you have everything you need for your business and your location. Download MOBI's Licenses and Permits Checklist (PDF) (shown below).

THE TOP 10 DO'S

- Research early to understand all required licenses and permits before starting your business.

- Check the zoning laws for your location and type of business.

- Maintain organized records of all licenses, permits, and renewal dates.

- Include the costs of licenses and permits in your business budget.

- Consult professionals. Seek advice from attorneys and accountants to ensure you meet all the legal requirements for your specific business.

- Register a fictitious business name or DBA if needed.

- Understand if you need any special certifications for your type of business.

- Plan and be prepared for any required health, safety, or building inspections.

- Get a seller’s permit if you are selling products, or physical items as part of your service.

- Make sure you have all the necessary licenses and permits if you have a food related business.

THE TOP 10 DON'TS

- Research early to understand all required licenses and permits before starting your business.

- Check the zoning laws for your location and type of business.

- Maintain organized records of all licenses, permits, and renewal dates.

- Include the costs of licenses and permits in your business budget.

- Consult professionals. Seek advice from attorneys and accountants to ensure you meet all the legal requirements for your specific business.

- Register a fictitious business name or DBA if needed.

- Understand if you need any special certifications for your type of business.

- Plan and be prepared for any required health, safety, or building inspections.

- Get a seller’s permit if you are selling products, or physical items as part of your service.

- Make sure you have all the necessary licenses and permits if you have a food related business.

If you are writing your business plan while reviewing this material, take a moment now to include any information about your business related to this session. MOBI’s free Business Plan Template and other worksheets, checklists, and templates are available for you to download. Just visit the list of MOBI Resource Documents on the Resources & Tools page of our website.

Here are some key terms and definitions used in this session or related to this session:

| Term | Definition |

|---|---|

| Board of Equalization | Agency of the government that is responsible for functions related to taxation. |

| Business License | A business license is an official permit or authorization from your local government that allows you to legally operate a business within a specific area or jurisdiction. Also known more formally as a "business tax license." |

| Business Plan | A written outline that evaluates and describes all aspects of your business. |

| Business Tax License | Also known more simply as a “business license.” A business license is an official permit or authorization from your local government that allows you to legally operate a business within a specific area or jurisdiction. |

| Cottage Food Business | A type of small-scale food business where individuals prepare and sell homemade food products from their own homes such as baked goods, jams, candies, etc. |

| DBA | Doing Business As, or the name under which you will operate your business. Also known as a fictitious business name. A DBA or fictitious business name can help establish your business as a separate legal entity. You may be required to file your fictitious business name with your local city government depending on the laws in your area. |

| EIN | An Employee Identification Number is a unique, nine-digit identifier assigned by the IRS to track your business's financial activities, such as tax reporting and hiring employees. Also known as a Federal Tax ID Number. An EIN is recommended for all business to protect the privacy of your SSN or ITIN on documents. |

| Escrow | When purchasing a business, going through escrow means working with a neutral third party to manage the transaction, rather than making the purchase directly from the seller. This process helps ensure the safety and fairness for both parties involved in the transaction. |

| Entity |

The legal structure or organization of your business such as sole proprietorship, Limited Liability Company (LLC), partnership, etc. |

| Federal Tax ID Number | A unique, nine-digit identifier assigned by the IRS to track your business's financial activities, such as tax reporting and hiring employees. Also known as an EIN. An EIN is recommended for all business to protect the privacy of your SSN or ITIN on documents. |

| Fictitious Business Name | The name of your business, or the name you will be Doing Business As, also known as a DBA. This is important for invoicing, bank accounts, taxes, and more. You may be required to file and/or publish your fictitious business name with your local city government depending on the laws in your area. |

| Keogh Plan | A type of retirement savings plan designed for self-employed individuals and small business owners. |

| Municipal | Relating to your city or town's local government, like municipal laws, services, or property taxes. |

| Seller's Permit | A permit that allows you to collect sales tax from your customers which you, in turn, pay to the state. It is sometimes referred to as a "Certificate of Resale" or "Certificate of Authority," and it is different from a business license. |

| Trademark | A legal symbol, like a brand name or logo, that identifies and protects a business's unique products or services from being used by others without permission. Trademark protection is not automatic, you need to register it with the appropriate government agency. |

| Variance |

A special permission granted by the local government that allows you to use property in a way that is not ordinarily allowed by the current zoning laws. |

| Zoning Compliance Permit | A zoning compliance permit is official permission from your local government that says your business location and activities meet the zoning rules and regulations for that area, ensuring you can legally operate there. |

| Zoning and Zoning Ordinance | A zoning ordinance is a set of local laws that divide a city or town into different zones or areas, specifying what types of activities or buildings are allowed in each zone, and it's important for businesses to follow these rules when choosing a location. |