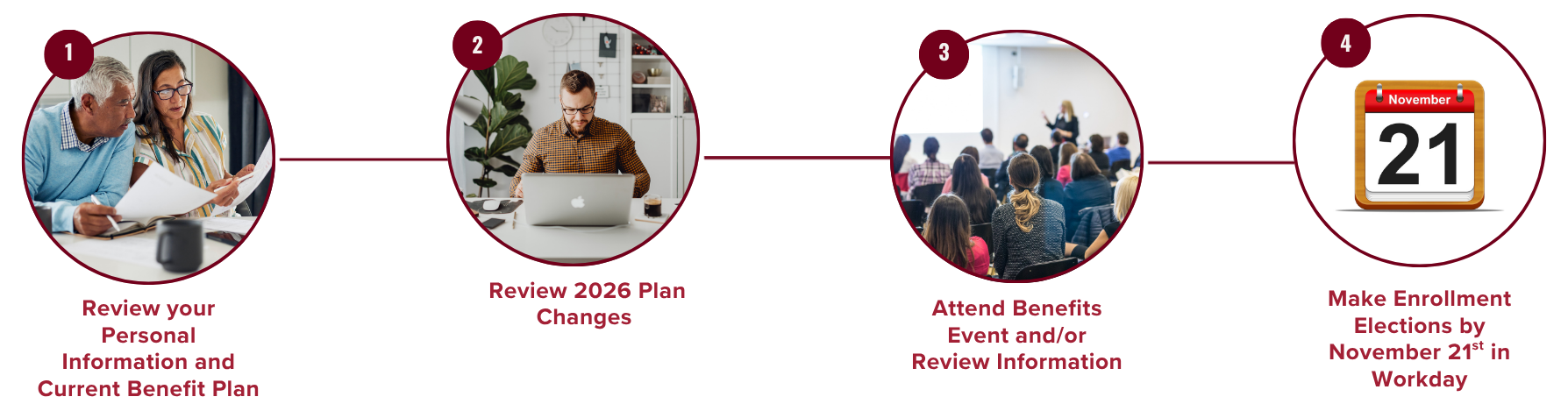

November 5th

Open Enrollment BeginsNovember 21st

Open Enrollment EndsSteps for Open Enrollment

Open Enrollment is the perfect time take inventory of your Workday records. Review and make necessary adjustments to personal information, such as address and phone number, and confirm that your designated life insurance beneficiaries are current. Look over your current 2025 benefit plan enrollments in preparation for deciding whether to make changes in 2026.

- If you need to update any personal information: Modifying Personal Information

What to know:

| Medical | Dental and Vision |

|---|---|

|

2026 Enhanced Fertility Benefits Aetna:

Aetna Medical Provider Look Up Aetna HMO In Network Medical Groups Kaiser

|

Guardian Dental

Guardian - Find A Dental Provider Anthem Blue View Vision

|

| Medical FSA | Dependent Care FSA | Mass Transit FSA |

|---|---|---|

|

Medical Care FSA can reimburse for eligible healthcare expenses not covered by your medical, dental, and vision insurance.

|

Dependent Care FSA can be used to pay for a child's (up to the age of 13) childcare expenses and/or care for a qualifying household member who is unable to care for themselves.

|

Mass Transit FSA can be used to cover qualified transit passes, vanpooling, payments for transportation in a commuter highway vehicle, and qualified parking costs.

|

| Health Savings Account (HSA) | Retirement | Life Insurance |

|---|---|---|

|

Those enrolled in the Aetna OAMC PPO HD Health Plan can contribute to an HSA account. This allows individuals to use pre-tax dollars to help pay for qualified healthcare expenses like deductibles, copayments, and other out-of-pocket expenses)

|

Santa Clara University's retirement benefits help employees build long-term savings and a source of income during retirement. In addition to SCU's defined contributions, eligible employees may make voluntary pre or post-tax contributions. Once eligible, employees can enroll or make changes at any time. 2026 maximums have not yet been announced.

|

Employees can elect to supplement SCU's Basic Life and AD&D coverage for themselves and their dependents. Coverage may be subject to approval by SCU's life insurance carrier, Sun Life. SunLife 2025 Life AD&D Benefit Summary

|

Attend our annual benefits expo

Register for an upcoming Open Enrollment Informational Session by clicking on a date below:

- November 11, 2025, 1:00 pm - 2:00 pm via Zoom

- November 17, 2025, 11:00 am - 12:00 Noon via Zoom Registration

- Starting on November 5, eligible employees will see an Open Enrollment task in their Workday inbox.

- Open Enrollment is the one time a year all benefits eligible employees can make changes to their benefits elections. All elections need to be submitted by November 21, 2025.

- As they go through their enrollment in Workday, employees may save their progress at any point and come back to submit their elections at a later time by selecting the "Save for Later" button. The item will remain in their Workday inbox with the saved progress. They must login by November 21 to submit the changes for the choices to be processed as part of their 2026 plan elections.

- Need to make a change after you submit? Click on the Benefits and Pay app in Workday. Under "Needs Attention" click the "Edit" button for the Benefit Event: Open Enrollment.

- Open Enrollment User Guide 2026

2026 Benefit Rates (PDF)

A breakdown of the 2026 medical, dental, and vision plans rates

2026 Benefits Information Guide

A document with a brief summary of the various benefit plans.

ALEX: Interactive Benefits Decision Tool

ALEX by Jellyvision is an interactive learning tool. ALEX uses audio and dynamic visual images to explain our benefits so you can select the plans that best suit your needs

Benefit Vendors/Providers Contact Information

- Aetna HMO/AWH: (800)445-5299 (Group #: 237642)

- Aetna OAMC PPO HDHP: (877)204-9186 (Group #: 237642)

- Guardian Dental Member Services: (800)541-7846 (Group #: 00056564)

- Kaiser Member Services: (800)464-4000 (Group #: 979)

- Anthem Blue View Vision: (866)72-0515 (Group #: 175028)

- Health Advocate Help Find a Doctor: (866)695-8622

- Health Equity Member Services: (877)857-6810

- WEX Member Services: (866)451-3399

If you still have further questions, please contact scu-benefits@scu.edu or Register for a 1:1 with a Benefits Team Member.